trust capital gains tax rate uk

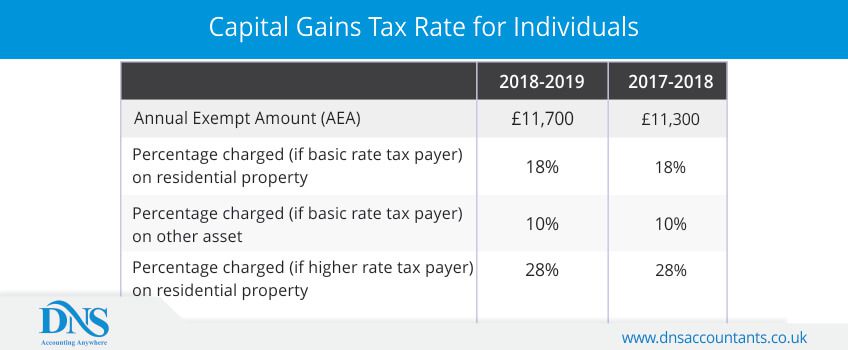

10 18 for residential property for your entire capital gain if your overall annual income is below 50270. Offshore trusts are also exempt from capital gains tax on any arising capital gains provided they do not arise on UK trading assets or UK residential property.

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

If the settlor has more than one trust this.

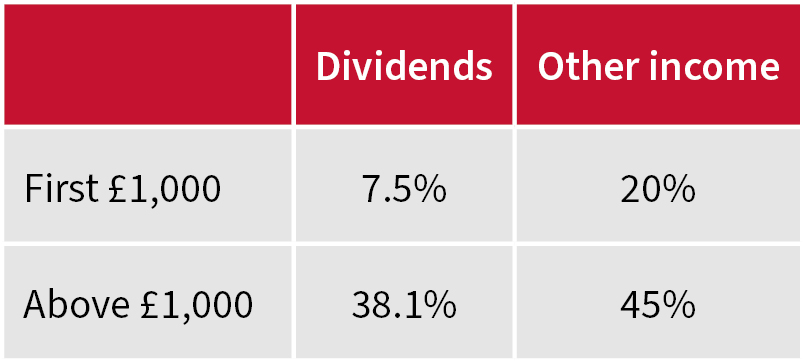

. First deduct the Capital Gains tax-free allowance from your taxable gain. Gains are not matched to capital payments made to non-UK resident beneficiaries except in the tax year a trust ceases. Thereafter dividend income is taxed at 381 while all other income is taxed at 45 2021-2022.

For example if you bought shares in a company and later sold them for an increased. Over the 20202021 tax year the basic rate on. The tax-free allowance for trusts is.

Trustees are responsible for paying tax on income received by accumulation or discretionary trusts. Basic rate payers and higheradditional rate payers. The first 1000 is taxed at the standard rate.

The current capital gains tax allowance is. Income tax rate above 1000 per annum 45. If a vulnerable beneficiary claim is made the.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. HS294 Trusts and Capital Gains Tax 2020 Updated 6 April 2022. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed.

20 28 for residential. However if a UK resident and. Capital Gains Tax rates in the UK for 202223.

Capital gains tax allowance. Capital gains tax This is charged in certain situations where an asset you own has increased in value. Add this to your taxable.

Examples of assets subject to capital gains taxes include homes stocks collectibles businesses and other similar assets. After you work out if you need to pay Capital Gains Tax is due if the total taxable gain is more than the Annual Exempt Amount eg. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount.

The following Capital Gains Tax rates apply. Thats about 15 of all UK tax receipts. The capital gains tax allowance is the amount of profit you can make from the sale of an asset before you have to pay capital gains tax.

18 and 28 tax rates for individuals. 10 and 20 tax rates for individuals not including residential property and carried interest. Rates of capital gains tax range from 10 to 28 depending on the income of the taxpayer and the type of asset sold.

The first 1000 is taxed at 75 dividend income or 20 all other types of income. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. Rates of tax.

Law info - all about law. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to. AEA is the tax-free allowance.

Most investors pay capital gains taxes at. The rate of tax on matched gains is up to 20 depending. CGT rates differ from income tax rates and are in two broad brackets.

From 6 April 2016 trustees gains are taxed at 28 on residential property or 20 on other chargeable assets. This helpsheet explains how United Kingdom UK resident trusts are treated for Capital Gains Tax CGT. 3935 dividend trust rate on income over standard rate band 0 875 3375 3935 Capital Gains Tax CGT Person liable for CGT on capital gains made by the trustees Trustees.

6000 divided by the number of trusts settled subject to a minimum of 1200 per trust Capital gains tax rate. Our Capital Gains Tax Manual CG. Areas of risk within Capital Gains Tax for trusts and estates Capital Gains Tax for trustees and personal representatives is charged at 20 per cent on gains.

2 minute read November 3 2022 1106 PM UTC Last Updated ago UK considers cutting tax-free dividend allowance increasing capital gains tax -media. It also deals with.

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Trust Capital Gains Expert And Experienced Tax Advice Etc Tax

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What Are The Advantages And Disadvantages Of Family Trusts

How Are Capital Gains Taxed Tax Policy Center

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Taxation In The Republic Of Ireland Wikipedia

Tax Pools Make Sure Trustees Don T Get Out Of Their Depth Aj Bell Investcentre

How Do Us Taxes Compare Internationally Tax Policy Center

Taxation In The United Kingdom Wikipedia

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Tax Systems Of Scandinavian Countries Tax Foundation

A Guide To The Net Investment Income Tax Niit Smartasset

Capital Gains Tax Calculator How To Calculate Dns Accountants

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center